Understanding Mortgage Basics: Which Loan Type is Right for You?

Written by Eddie Cohen - January 5, 2025

Thanks for visiting our blog! This is our first blog post and will be posting weekly.

Our objective is to help you feel more comfortable with the homebuying process and mortgage financing which can be at times, overwhelming.

When you're ready to buy a home, understanding the types of loans available is crucial. Choosing the right mortgage can save you money and reduce stress during the homebuying process. In this post, we'll explore the most common mortgage types and their benefits.

Types of Loans:

1. Conventional Loans

* Backed by GSE's (Government Sponsored Entities) such as Fannie Mae & Freddie Mac.

* Ideal for buyers with strong credit and a solid financial history.

* Benefits: Competitive interest rates, flexibility, and no upfront mortgage insurance fees.

* As little as 3% down payments available.

2. FHA Loans

* Backed by the Federal Housing Administration.

* Designed for buyers with lower credit scores or limited down payment funds.

* Benefits: Lower down payments (as low as 3.5%), more flexible credit requirements.

3. VA Loans

* Available to eligible veterans, active-duty service members, and some surviving spouses.

* Backed by the Department of Veterans Affairs.

* Benefits: No down payment, no mortgage insurance, and competitive interest rates.

4. USDA Loans

* Backed by the U.S. Department of Agriculture.

* For buyers in eligible rural and suburban areas.

* Benefits: No down payment and low mortgage insurance costs.

5. Jumbo Loans

* For properties that exceed conventional loan limits.

* Designed for high-income borrowers.

* Benefits: Enables financing for luxury homes or properties in high-cost areas.

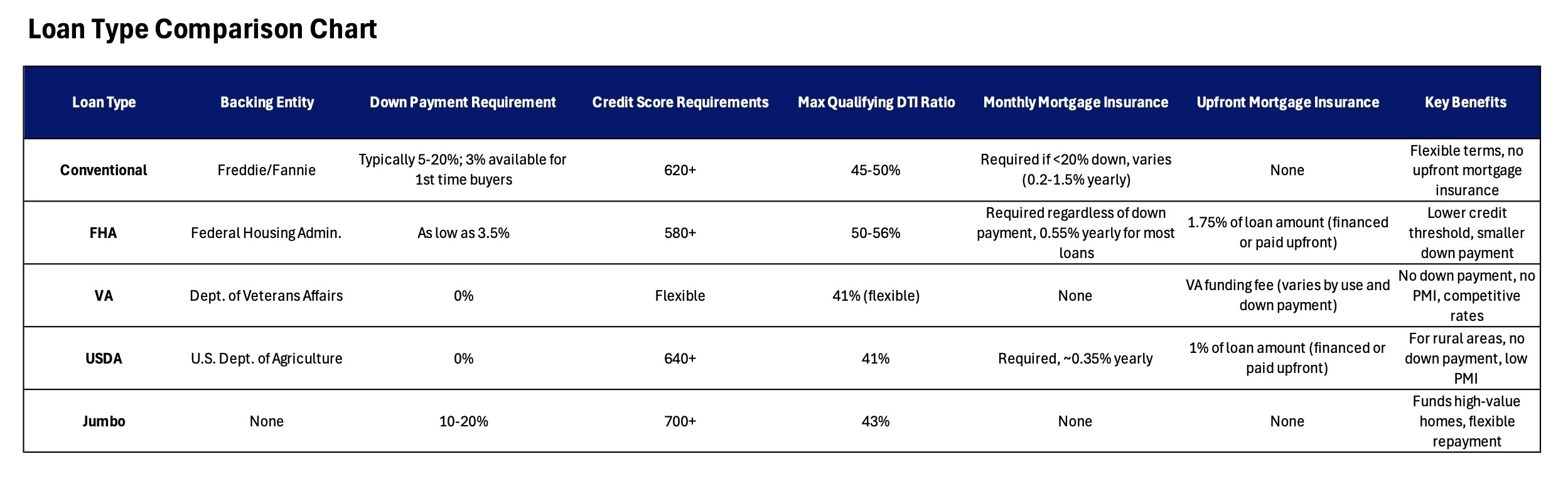

For the visual learners in the audience - here is a little chart we created to help with some of the main points of each loan type.

Conclusion: Understanding these mortgage options can help you choose the one that fits your financial situation. Now there are many more things to consider when choosing which path makes the most sense for you so be sure to speak with a professional. Consult with a trusted Cohen Mortgage licensed loan officer to explore these options and find the right path to homeownership.

Ready to explore your mortgage options? Contact us today.

Click Here To Reach A Licensed Loan Officer

OR

Comments

This is great! We’re ready to buy a house now !

Comment Submitted!